- #TAX PLANNER PRO FOR FREE#

- #TAX PLANNER PRO UPGRADE#

- #TAX PLANNER PRO FULL#

- #TAX PLANNER PRO PLUS#

- #TAX PLANNER PRO PROFESSIONAL#

It sounds more convenient than pulling out a debit or credit card on the spot, but beware: a $39 processing fee applies. If you're expecting a tax refund, H&R Block will ask if you want to use part of it to pay for its tax prep services. These services start at $80 for a federal return.

#TAX PLANNER PRO UPGRADE#

#TAX PLANNER PRO PLUS#

Supports everything in the Deluxe version, plus rental property income and freelance/contractor income below $5,000. Everything the free version includes, plus the mortgage interest deduction and health savings accounts, and you can itemize. Notably, H&R Block's free version includes student deductions, while TurboTax's does not. You can't itemize deductions, but that's typical of a free version.

#TAX PLANNER PRO FOR FREE#

With all versions except the computer software, you can prepare your return for free - you only pay when it's time to file.

#TAX PLANNER PRO FULL#

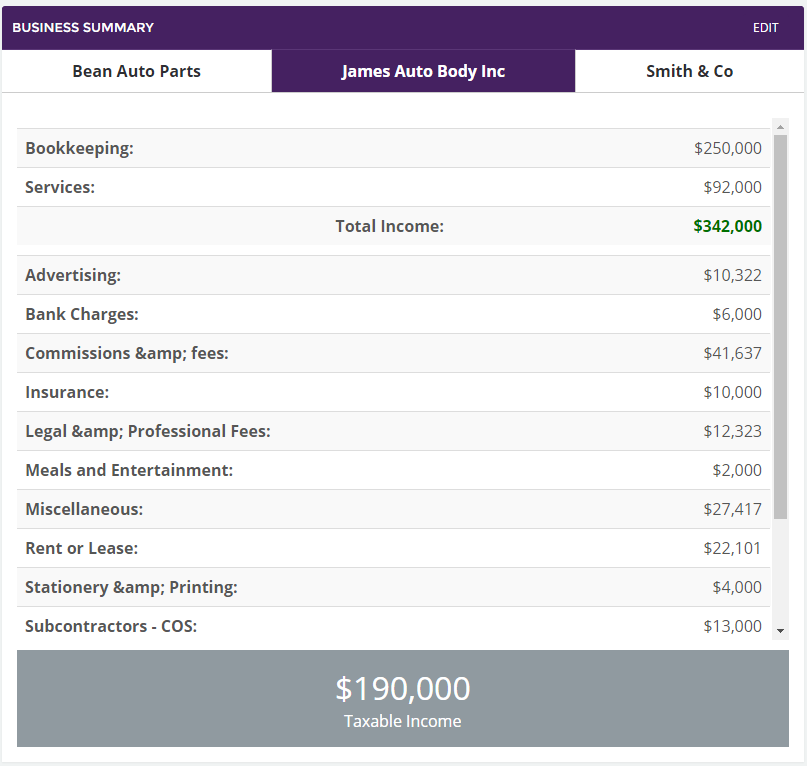

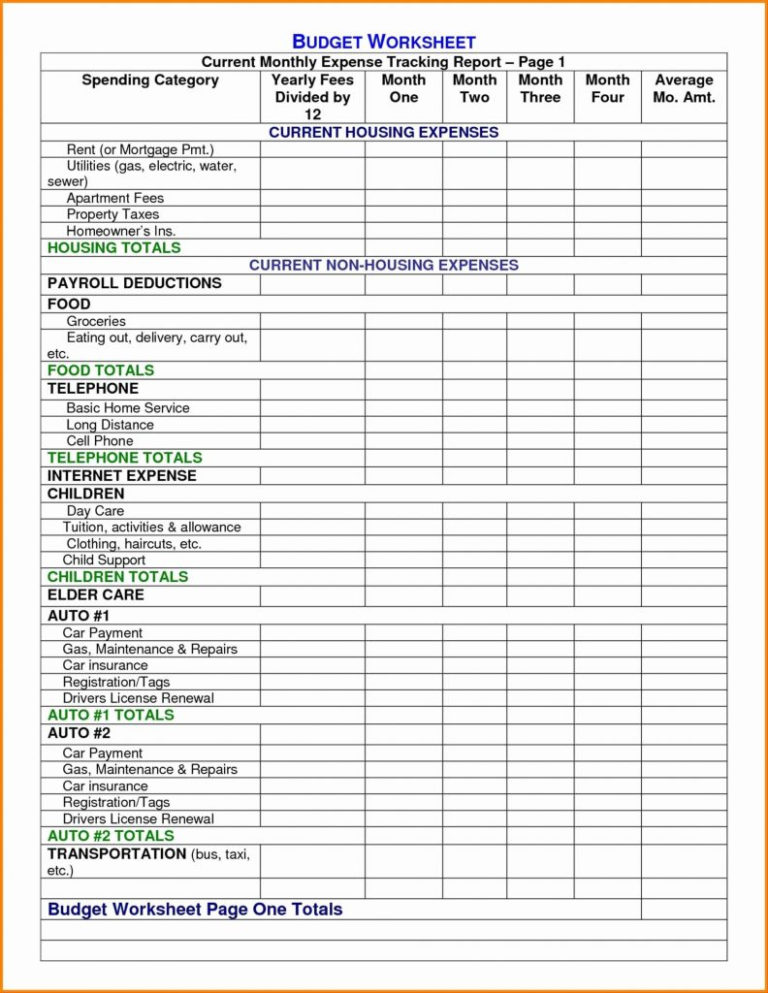

extra help from an expert), full service from a tax preparer, and downloadable computer software.Įach of these categories offers different price points, which are determined by which tax forms you need. H&R Block offers four main ways to prepare and file taxes: do-it-yourself online packages, the option to add Online Assist (i.e. The cost of filing with H&R Block is less than TurboTax, but more than TaxSlayer, TaxAct, or Cash App Taxes. The prices listed in this article do not include any discounts. Tax prep companies frequently offer discounts on products. Already track business expenses in QuickBooks, a TurboTax partner.You Might Not Like Filing With H&R Block if You: Appreciate a clean and modern digital interface.

#TAX PLANNER PRO PROFESSIONAL#

I used the Deluxe Online package to prepare and file both my federal and state returns (more on the specs of this option below).

I didn't own a home, have any dependents, or invest outside of my retirement accounts. Anyone who hasn't filed taxes solo before or recently experienced significant life changes would benefit from the guidance H&R Block provides.įor several years, my situation was pretty simple, with W-2 income, a health savings account, and interest income from a high-yield savings account. If you're doing your own taxes this year and, like me, willing to pay for convenience, you'll find an option that suits your needs at H&R Block. W-2 income unemployment income retirement distributions interest and dividend income tuition and fees deduction student loan interest deduction earned income tax credit child tax credit Upgradeable for instant access to a tax expert.Completely free option for simple tax situations at any income level.The free version is more comprehensive than free plans from other services. Across all versions, the user interface is modern and easy to use. H&R Block offers products comparable to TurboTax at a lower price.

0 kommentar(er)

0 kommentar(er)